Below are some examples of the different types of POS Transactions in Idealpos. The examples show how the transaction should appear in the MYOB Transaction Journal and will show if the example is for Cash, Accrual or Cash and Accrual GST Accounting Basis.

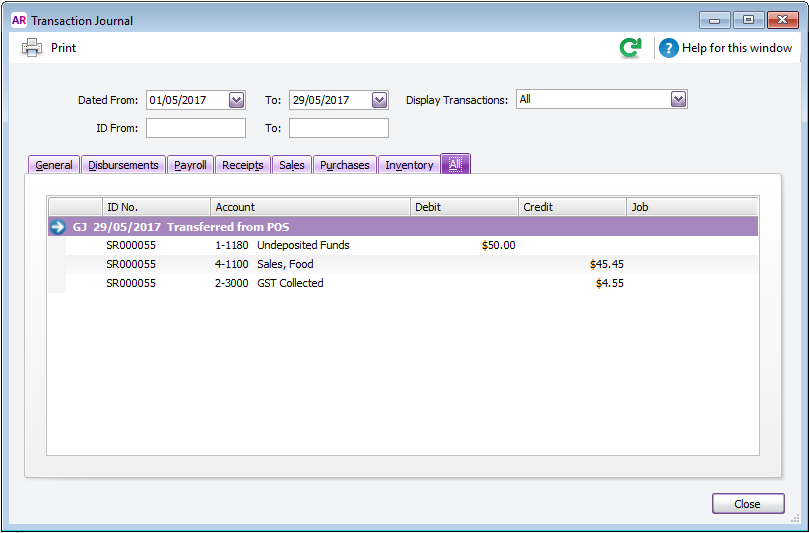

Sale – All Items GST Inc. – Cash & Accrual

A Sale for $50.00 Inclusive of GST - paid by Cash.

Sale – Items are GST Inc. and Ex – Cash & Accrual

A Sale for $42.00 inclusive of GST and $46 exclusive of GST – paid by cash.

Sale with EFTPOS Cash-Out – Cash & Accrual

A Sale for $50.00 Inclusive of GST with a cash-out amount of $10.00.

A Refund of $10 Beverage and a $10 Sale of Food.

A Sale for $50. $25 paid on Cash and $25 paid on EFTPOS.

A Sale for $40.99 Inclusive of GST with 1c Rounding as it was paid by Cash.

Several Sales totalling $100 in the End of Shift and a Variance of $5 entered as the Cash was less than expected.

A $50 Sale was saved to a Bar Tab then paid with Cash.

A Customer Opened a Bar Tab and want to Pre Pay $500.

Accumulated Sales totalling $500 were saved to this Bar Tab. When paid, the pre-paid amount of $500 was applied to the sale.

Refund/Void Mode Transaction – Cash & Accrual

A Cash Refund/Void Mode for $50.00 Inclusive of GST.

A Refund on a $50 item and issued $25 Cash and $25 EFTPOS to the customer.

A Refund on a $50 item and issue a Credit Note.

A Sale of $50 paid with a Credit Note of $50.

A Lay-by sale of $50 Inclusive of GST with a $10 Deposit paid on Cash.

A Part payment is sent to MYOB the same as the first payment.

A final Lay-by payment of $30.00 paid on Cash. On the final payment, the GST and Sale amount is sent to MYOB.

A Lay-By sale of $50 Inclusive of GST with a deposit of $10.00 Cash. An Adjustment of $1.00 was applied to this Lay-By with an owing balance of $39.00.

Lay-By Debit Adjustment – Accrual

(NB. This can only be processed if Global Debtor not activated)

A Lay-By sale of $50 Inclusive of GST with a deposit of $10.00 Cash. An Adjustment of $1.00 was applied to this Lay-By with an owing balance of $41.00.

Cancel a $50.00 Lay-By with a deposit of $10.00 Inclusive of GST.

Cancel a $50.00 Lay-By with a deposit of $10.00 and a service fee of $5.00 and refund of $5.00.

Lay-By Sale & First Payment – Cash

A Lay-by sale of $50 Inclusive of GST with a $10 Deposit paid on Cash.

A Part payment is sent to MYOB the same as the first payment.

A final Lay-by payment of $25.00 paid on Cash.

A Lay-By sale of $50 Inclusive of GST with a deposit of $10.00 Cash. An Adjustment of $1.00 was applied to this Lay-By with an owing balance of $39.00.

Cancel a $50.00 Lay-By with a deposit of $10.00 Inclusive of GST.

Cancel a $50.00 Lay-By with a deposit of $10.00 and a service fee of $5.00 and refund of $5.00.

Using the RA and PO Functions for Tips in and Out does not record GST. If you wish to record GST on Tip that have been collected, we recommend using a Stock Item with GST set.

A $10 Tip has been entered and tendered on Cash.

A $10 Tip has been taken out and tendered on Cash.

A $20 Paid in has been entered and tendered on Cash.

A $20 Paid Out transaction tendered on Cash.

A Gift Voucher Sale of $100 paid by Cash.

A Sale of $100 paid by Gift Voucher.

A Gift Voucher Sale of $100 paid on Account.

A Gift Voucher Sale of $100 paid by Points.

No Journal is sent to MYOB.